The Howard Jarvis Taxpayers Foundation continues to battle in the courts to have Measure ULA, the Los Angeles “mansion tax,” declared invalid for plainly violating the state constitution’s prohibition on real estate transfer taxes for a special purpose. After a Los Angeles Superior Court judge let the law stand based on the questionable theory that the constitution doesn’t apply to “citizens’ initiative tax increases,” HJTF attorneys filed a notice of appeal, which is proceeding.

Measure ULA, approved by 57.77% of voters in the city of Los Angeles in 2022, imposed a 4% tax on the sale or transfer of property with a value of between $5 million and $10 million. Above that, the tax jumps to 5.5%. To be clear, it is not a tax on profits, but on market value. Even if the property is in foreclosure, the tax is still owed.

Voters were told the “mansion tax” could raise between $600 million and $1 billion every year for housing and homelessness programs, but a report in Westside Current by Angela McGregor notes that the actual revenue from Measure ULA is nowhere near those projections. “As of April, 2024, the tax has brought in just $215 million over 16 months,” McGregor wrote. Instead of solving the housing and homelessness problems in Los Angeles, Measure ULA has “put a damper on all real estate development, resulting in less development of both market-rate and affordable projects.”

Many properties and development projects in Los Angeles that are worth more than $5 million are not mansions. Some are multi-family housing, also known as apartments. Some are office, industrial or commercial buildings. Some are affordable housing projects.

An August 8 report from the Los Angeles Office of Finance said that since the tax took effect in April 2023, only about 46% of the revenue collected came from the sale or transfer of expensive single-family homes. Most of the revenue, about 54%, was skimmed from the sale of apartment buildings, retail stores, offices and other non-mansion real estate.

If our appeal is successful, we believe those who paid this invalid tax will be entitled to refunds.

ARTICLE DIRECTORY:

- Victory for Proposition 13 and Taxpayers

- What Wasn’t on Your Ballot: The Taxpayer Protection Act

- President’s Message: Should California Return to a Part-Time Legislature

- HJTA President Jon Coupal Honored in Orange County

- 2024 HJTA Legislative Report Card

- HJTA in Action

- Thank You, Allison Dynda Sain!

- Under The Dome: HJTA’s Legislative Report Card Shows Who’s on Your Side

- Support HJTA and All Its Affiliated Entities to Protect Taxpayers

- Here’s How to Listen to all the Howard Jarvis Podcasts

- The Legal Front: California Supreme Court Agrees to Hear HJTA’s Appeal on Pension Bond Question

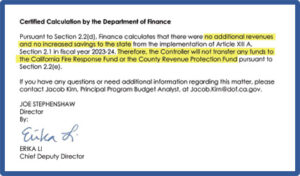

- Your Questions Answered: How Much Money from Proposition 19 has Gone to the California Fire Response Fund as Promised?

- Foundation Report: Fighting an Invalid “Mansion Tax”

- RETURN TO MAIN MENU