Without a doubt, the most deceptive and dangerous measure on the 2024 ballot is Proposition 5, a constitutional amendment proposed by the legislature that would make it easier to raise property taxes.

Proposition 5 is the measure formerly known as Assembly Constitutional Amendment (ACA) 1. It’s an attack on the important taxpayer protection in Proposition 13 (and in earlier versions of the state Constitution) that requires a two-thirds vote of the electorate before a city, county or special district can borrow money by issuing bonds.

Local bonds are repaid by putting new charges on property tax bills. Those charges continue for decades, and each new bond measure that is approved by voters is added on top of previous charges, in addition to the basic property tax of 1% of assessed value.

Back in 2000, California voters were persuaded to change the Constitution to allow school bonds to pass with just 55% voter approval, instead of two-thirds (66.7%). Many more bonds were approved under this lower standard, as any homeowner can see on their property tax bill. Charges for bond debt are listed in the section labeled “voted indebtedness” or something similar.

Proposition 5 would lower the standard for approving local bonds to 55% for almost everything. It applies to “infrastructure,” which is broadly defined, and also to “affordable housing,” again defined so broadly that it even includes cash assistance for down payments.

An earlier version of ACA 1 also lowered the vote threshold for passing special taxes, such as parcel taxes and sales taxes, but lawmakers scrambled at the last minute to take out the provisions applying to special taxes after polling indicated that voters would say no.

Voters should say no anyway. Bonds are debt, and debt is repaid with tax increases. The only difference between the old version of ACA 1 and the new one is that now the “easier” tax increases are exclusively property tax hikes. Everyone still pays them, regardless of whether they are homeowners or renters. Higher property taxes on an apartment building or other rental property are eventually passed through to tenants as higher rents, and higher property taxes on a business property are passed through as higher consumer prices.

By making it easier to raise property taxes, Proposition 5 will raise the cost of living even higher in California, which already has the highest poverty rate in the nation when the cost of living is taken into account.

Deceptively, proponents of Proposition 5 claim that it is not a tax increase. In fact, it’s something much worse. It’s an engine for more and more tax increases, enabling more bond debt to be proposed and approved in every election, in every city, county and special district. The resulting property tax increases get around the limits in Proposition 13, so property tax bills will rise and many California homeowners could soon be at risk of losing their homes.

The framers of California’s government were well aware of the risk of excessive debt. The 1849 California Constitution, a handwritten document now in the state’s archives, warns in Article IV, Section 37, “It shall be the duty of the Legislature to provide for the organization of cities and incorporated villages, and to restrict their power of taxation, assessment, borrowing money, contracting debts, and loaning their credit, so as to prevent abuses in assessments and in contracting debts by such municipal corporations.”

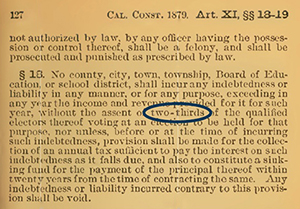

California’s 1879 Constitution formalized this directive. Article XI, Section 18, states, “No county, city, town, township, Board of Education, or school district, shall incur any indebtedness or liability in any manner, or for any purpose, exceeding in any year the income and revenue provided for it for such year, without the assent of two-thirds of the qualified electors thereof....”

But today’s state legislature wants to throw away that protection and empower cities, counties and special districts to incur indebtedness with the approval of only 55% of voters.

Proposition 5 would override the thoughtful and longstanding protections in the current Constitution. It is a constitutional amendment, requiring only a simple majority, 50%-plus-one-vote, to pass.

Proposition 5 is a costly, dangerous proposal that will lead to an exponential increase in local government debt that must be repaid by property owners, and without regard to ability to pay. Please tell your friends and neighbors how important it is to watch the mail for their ballots in early October and to vote “No on 5.”

ARTICLE DIRECTORY:

- Vote No On 5 to Stop the Tax Hikes

- NO on 2 and 4: $20 Billion In Debt for School Buildings, Climate Projects

- President's Message -Californians Losing Confidence in State's Political Leadership, and Rightly So

- It Has Never Been More Important to Support HJTA

- Shockingly High Government Salaries Raise Questions About Local Tax Hikes

- Under The Dome: A 'Whose Line Is It Anyway' Democracy

- Check Your Ballot Closely for "Upland" Taxes. Here's Why.

- What's Happening with the Effort to Repeal the Death Tax?

- HJTA Election Guide: Candidate Endorsements

- HJTA Election Guide: Ballot Measure Recommendations

- The Legal Front: California Supreme Court Erases Taxpayer Protection Act from Your November Ballot!

- Foundation Report: Battling for Taxpayers in the Courts

- Your Questions Answered: Property Tax Postponement Program

- RETURN TO MAIN MENU